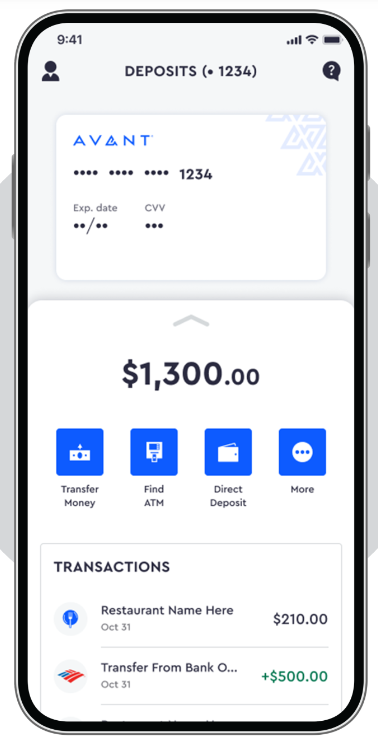

avant credit card create account

In this Avant credit card review, we will certainly talk about whether this card is a excellent suitable for those with a restricted credit rating. Although the AvantCard does not impact your credit report when you use, it is an unsecured item that does have a tiny credit line The Avant Personal Loan 2022, on the other hand, does not need a credit report whatsoever. The consumer testimonials and contrast chart below ought to be of help for those who are thinking about making an application for this personal loan.

The Avant credit card is a strong choice for a credit-building individual with fair to average credit report. The annual fee is inexpensive as well as the credit limit is a good beginning point. The Avant card also enables you to prequalify without a hard pull on your credit. As long as you are over the age of eighteen, this sort of credit card is an superb choice for establishing a solid credit rating. The Avant credit card review likewise highlights the advantages and downsides of this credit card.