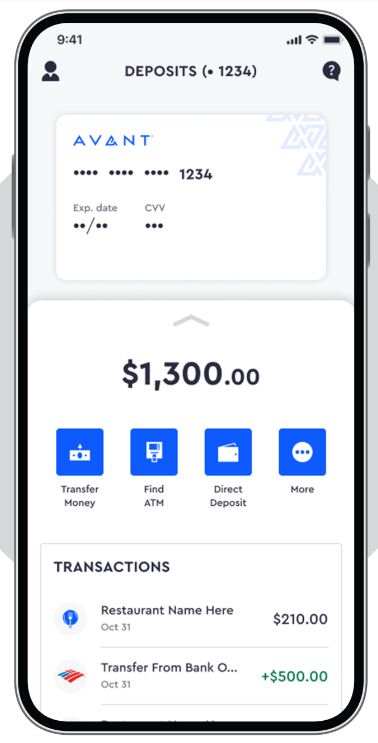

avant card bill pay

In this Avant credit card review, we will go over whether this card is a great suitable for those with a minimal credit rating. Although the AvantCard does not affect your credit history when you use, it is an unsecured item that does have a small credit line The Avant Personal Loan 2022, on the other hand, does not need a credit history in any way. The consumer reviews and also contrast graph below must be of help for those who are considering making an application for this personal loan.

The Avant credit card is a strong alternative for a credit-building individual with reasonable to ordinary credit history. The annual fee is affordable and also the credit limit is a respectable starting point. The Avant card likewise allows you to prequalify without a hard pull on your credit scores. As long as you are over the age of eighteen, this type of credit card is an excellent alternative for developing a solid credit report. The Avant credit card review likewise highlights the advantages as well as disadvantages of this credit card.