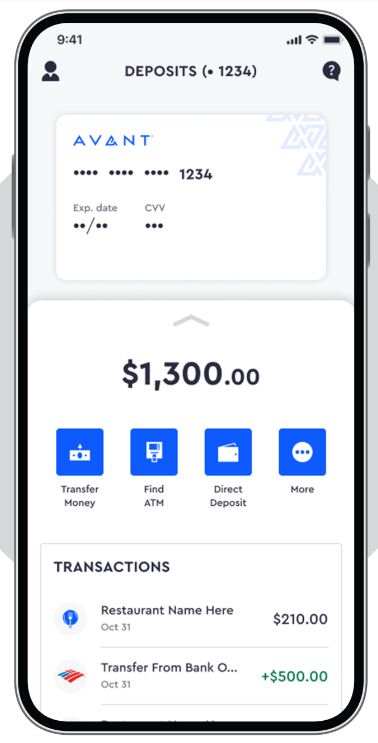

avant offer

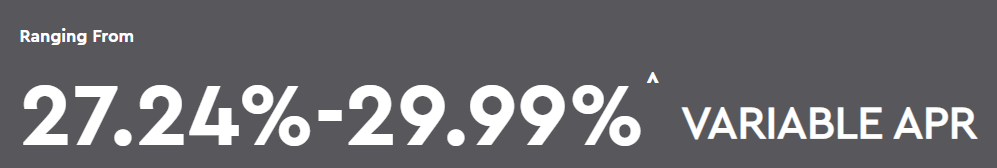

In this Avant credit card review, we will discuss whether or not this card is a great suitable for those with a minimal credit history. Although the AvantCard does not affect your credit report when you apply, it is an unsecured item that does have a small credit limit The Avant Personal Loan 2022, on the other hand, does not require a credit rating at all. The client evaluations and comparison graph below must be of help for those who are considering obtaining this personal loan.

The Avant credit card is a solid alternative for a credit-building person with reasonable to ordinary credit rating. The annual fee is cost effective as well as the credit line is a good beginning factor. The Avant card also permits you to prequalify without a hard pull on your credit report. As long as you more than the age of eighteen, this type of credit card is an exceptional choice for establishing a solid credit report. The Avant credit card review likewise highlights the benefits and also negative aspects of this credit card.